What is a credit score?

Most people often get confused about what actually a credit score is. Your credit score is just a number that indicates your creditworthiness. Simple right? Let’s dive deeper. Despite what many financial gurus think, your credit score is not an indicator of how you are doing financially.

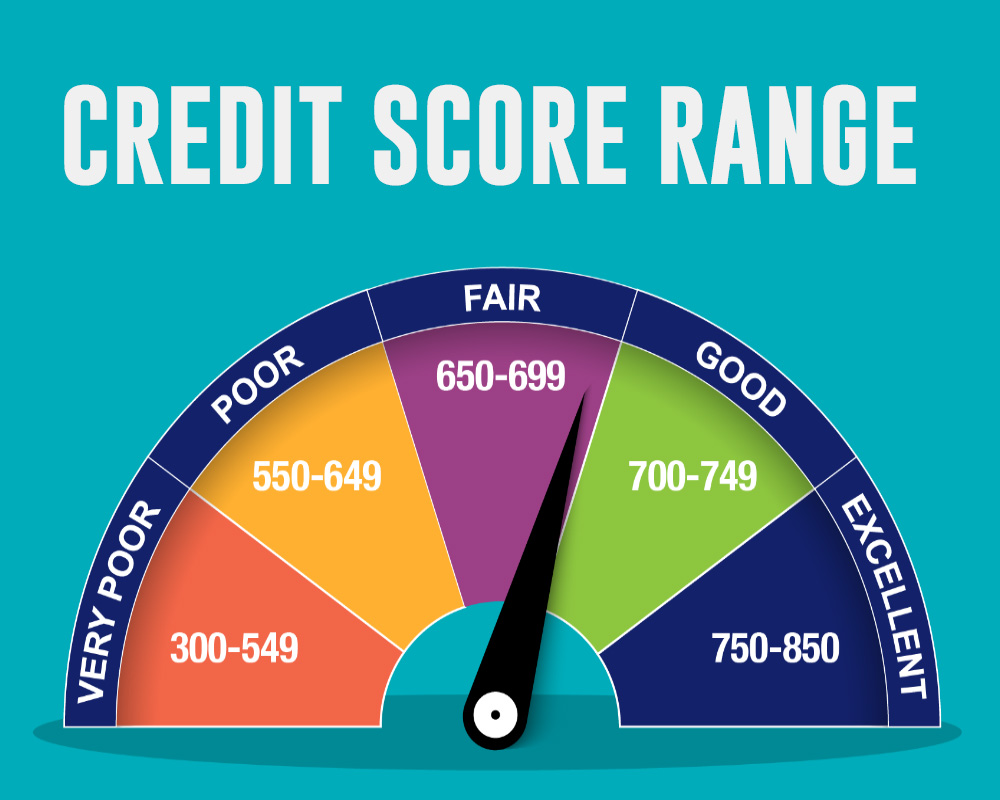

All that your credit score tells you is how good you are at borrowing money and paying it off. The credit score is counted between 300–850. The higher your credit score, the better chances for you to get a loan easily from any lenders. Also, your lenders can determine by your credit score, how likely are you to pay off the loans, and if you will repay the loans in a timely manner.

Although your credit score doesn’t indicate your financial status, it surely plays an important role in a lenders’ decision making process when it comes to offering you a loan. Furthermore, your credit score will determine if you are eligible for a loan. There are a lot of factors that determine your credit score.

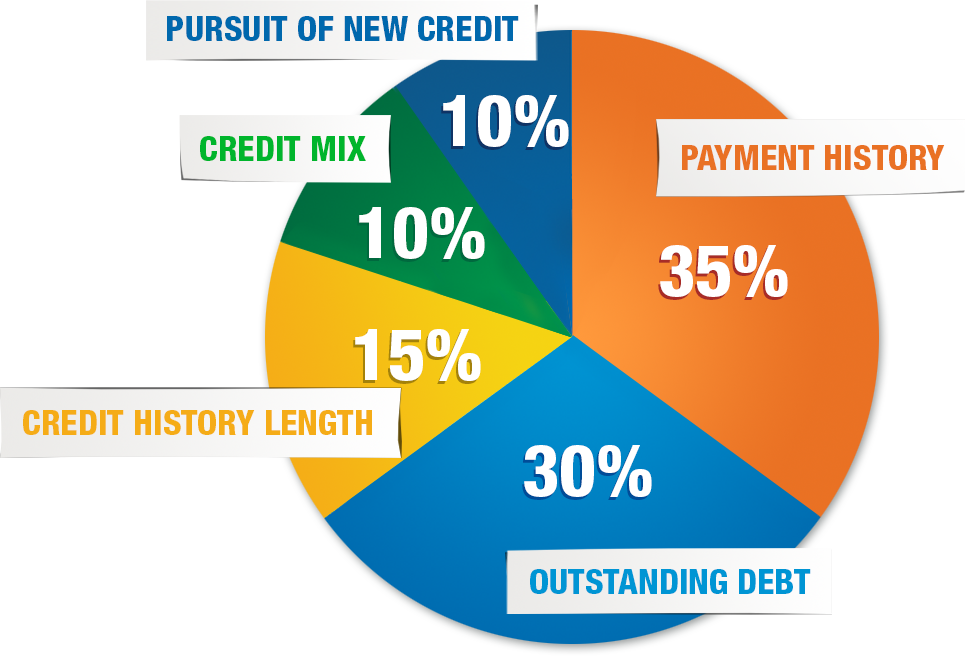

How is the Credit Score Determined?

35% of your credit score is based on your debt history. That shows how much you have borrowed over the years. 30% of your credit score is your current debt level. It is how much you owe right now. 15% of the score determines how long you have been in debt. 10% is any new debt you have acquired in the last 12-18 months and the final 10% is based on the type of debt.

The credit score model was created by the Fair Isaac Corporation, also known as FICO, and it is used by almost every financial institution all over the world. There are also, other credit scoring systems but the FICO score is the most commonly used credit scoring system. Your credit score keeps changing over time depending on your debt status.

How do Credit Scores work?

A credit score can directly affect your financial life. It helps a lender to determine if you are eligible for further credit. Having a good credit score can help you borrow money easily from any financial institution. On the other hand, people with a credit score lower than 640 will have to struggle to get a loan. People with lower credit scores are generally considered to be a subprime borrower. Which means they are considered to be relatively a high risk for lenders. Because of this, lenders often charge more interest rates on a subprime mortgage in order to compensate for more risk. Lenders might offer a lower payment or a shorter repayment term for people with low credit scores. Often borrowers might need a co-signer to get a loan.

On the other hand, a credit score above 700 is considered to be a good credit score. It becomes easier to apply and get approved for a loan. Also, the borrower can get a loan with relatively lower interest. So eventually they will have to pay less money in terms of interest over the years of paying off that loan. Borrowers can also get flexible repayment terms from the lender. Scores greater than 800 are considered excellent. While every creditor defines its own ranges for credit scores, here is the average FICO score range is often used by most lenders:

- Excellent: 800 to 850

- Very Good: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Poor: 300 to 579

How To Fix Your Credit Score

There are a lot of misconceptions about fixing credit scores. People often look for an easy way to get out of debt. Unfortunately, there are no easy ways and shortcuts to improve your credit scores overnight. There are a lot of companies who are offering to take care of and fix credit scores in no time. Although it may sound very promising and lucrative, these are mostly scams and you probably will end up in an endless loop of debt once you fall for those scams. The best way to fix your credit is by yourself. Yes, it will take some time and financial planning but if you do everything right you can easily repair your credit score.

If you’ve had an overdue student loan, years of high credit card balances, collections accounts, or even foreclosure, unfortunately, you probably have below-average or bad credit. When your information is updated on your credit report, you can see a change in your credit score depending on the updated information.

Having a poor credit score might not get you approved for any further loans or even credit products like credit cards. Even if you get a mortgage loan you will have to end up paying very high interest because of low credit score. When compared to someone with a good credit score, you might end up paying $40,000 more if you have a bad credit score. Over an entire lifetime, you could end up paying over $200,000 more in unnecessary interest just because of bad credit.

But you can change this by improving or repairing your credit score. It might take a while to do so. All you need is a little bit of knowledge and patience. Here are 7 easy steps to fix your credit scores:

1. Know Your Credit Status

Before you dive in to save your credit score, you need to get a copy of your full credit report from all three bureaus (Experian, TransUnion, and Equifax).

You can get this report free of charge once a year at www.annualcreditreport.com or by dialing 1-877-322-8228.

FICO Credit scores typically range from 300 to 850. A good credit score will help you qualify for the best credit cards with a low mortgage.

2. Dispute Your Errors

Although it isn’t very common, sometimes mistakes can happen on your credit report. You need to dispute any incorrect or false information on your credit report as soon as you can. Reviewing your credit report is very easy. Check all your information correctly.

Once you have the copy of your full credit report in hand, check your identity information (Social Security number, the spelling of your name and address), and credit history.

Review the list of credit cards, outstanding debts, and major purchases. If you see any mistakes or questionable items, make a copy of the report and highlight the error. Gather all the information needed together and make a copy of them. Write a letter to the specific credit reporting agency that shows the falsehood, whether it is Experian, Equifax, or TransUnion. Explain the mistake and include a copy of the highlighted report along with your documentation.

3. Stop Spending More Than You Can Afford

One of the biggest causes of bad credit score is people often spend more than they earn. If you want to fix your credit score, you need to make sure to stop unnecessary spending and create a budget according to your earning. To repair your credit score you will have to:

- Pay all of your bills on time

- Pay down debt (especially credit card debt)

- Avoid applying for credit

4. Pay Your Bills On Time

Your credit score won’t improve unless you start paying off all your monthly bills on time. If you’re behind on any bill, get caught up as soon as you can. On-time payments are the single most important factor in your credit score. Simply put, your credit won’t improve until you can consistently pay every bill on time.

5. Pay Your Credit Card Balances

If you have any outstanding balances on your credit cards, make room in your budget to pay down these debts bit by bit, every month until they are gone. Know your credit limits and make every effort to stay well under the maximum when charging items.

6. Don’t Apply For New Credit

This is a very common mistake that most of us make. Each time you apply for credit is listed on your credit report as a “hard inquiry” and if you have too many within two years, your credit score will suffer.

7. Don’t Close a Credit Card

Don’t close a credit card account: If you are not using a certain credit card, it is best to stop using it instead of closing the account. Depending on the age and credit limit of a card, it can hurt your credit score if you close the account.